AC Milan’s journey of success hasn't been awfully evident on the pitch this season, but it certainly has been off it. Once again, after the €6m profit in the 2022-23 financial year, the Rossoneri are heading for another achievement to celebrate. In collaboration with Felice Raimondo, we bring you the figures of the 2023-24 financial year.

A month or so back, we did a bonus article on the summer transfer window, breaking down the budget for Milan. Although it turned out to be more or less spot on, we weren’t able to bring you the exact figures of the 2023-24 financial year. Therefore, when Felice Raimondo published these on his Substack ‘Redblack Insights’, we thought it was the perfect opportunity to highlight his work.

As these figures are available completely for free on Raimondo’s Substack (check it out!), the following article will also be free. It’s essential for the fans to know more about AC Milan and especially the corporate side of things. If anything, the 2023-24 financial year confirms that the Rossoneri are on the right path, but now investments are needed. So without further ado, let’s dive in!

The 2022-23 financial year revisited

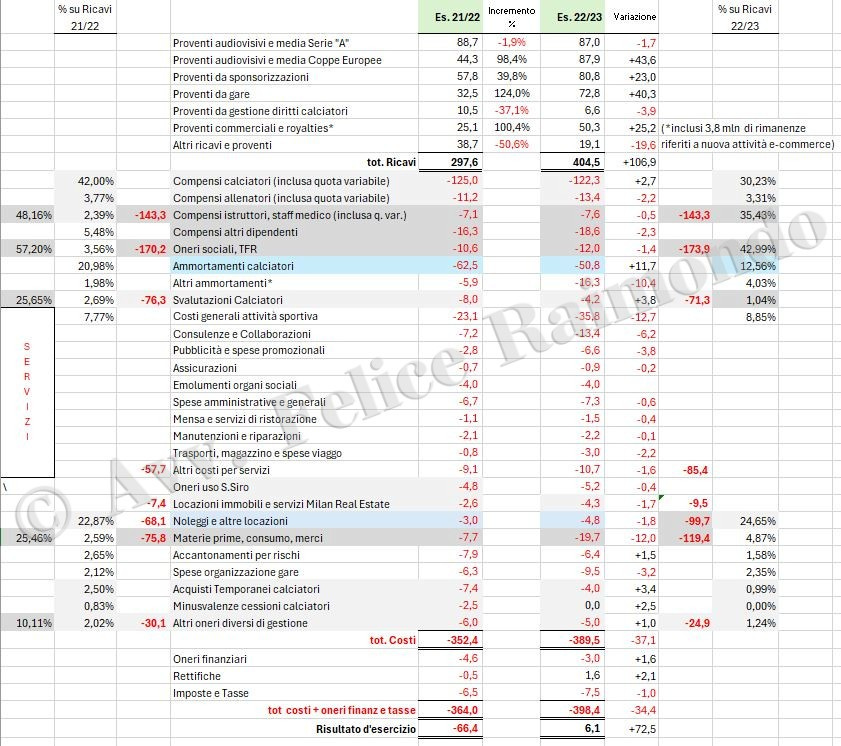

First of all, as pointed out by Raimondo, we must start with the financial year that ended on June 30, 2023 (i.e. 2022-23). It was a great success for Milan, with the first profit since 2006, and it also highlighted the tremendous growth that the club has experienced on more or less all fronts in recent years. Compared to 2021-22, in fact, the revenue exploded with an increase of €106.9m.

This increase can mainly be attributed to the following three factors:

New and hefty sponsorships as well as commercial sales: €130m total (+€48.2m)

Reaching the semis in the Champions League: €87.9m (+€43.6m)

Domestic and European ticket sales: €72.8m (+€40.3m)

It’s true that the Champions League campaign had a big effect on Milan’s financial year. No significant capital gains were registered during the financial year (€6.6m) and the Rossoneri still ended up with a profit of €6.1m. So, having been knocked out of the UICL group stage this season, what does that mean for Milan’s 2023-24 financial year? Let’s take a look at that next.

The projection for 2023-24 (with figures)

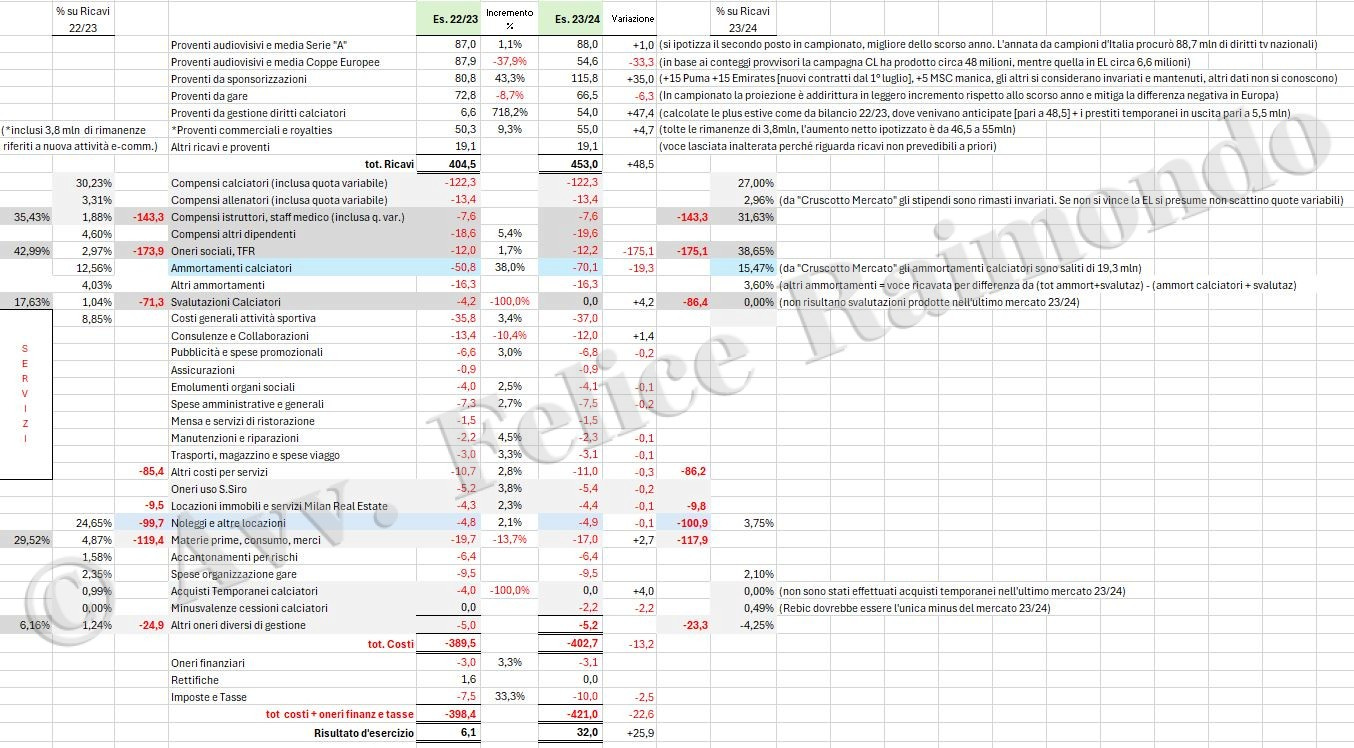

Many fans on social media have suggested that Milan’s are in trouble financially for not making it out of the UCL group stage, and getting knocked out against Roma in the Europa League quarters. Fortunately, this is not the case as the Rossoneri have a very (and we mean very) strong foundation to rely on. In fact, we are talking about yet another profit: €32m.

The broadcasting revenue from Serie A will remain more or less the same, perhaps slightly higher given that the Rossoneri are set to finish in second place this season (compared to fourth last time out). Staying on the broadcasting front, the big decrease is obviously linked to the Champions League and prize money from ditto, with a decrease of €33m in total. This is a blow that has been completely absorbed by increases elsewhere, as you will see below.

Thanks to the new agreements with Emirates and Puma, bringing in an extra €15m each, the revenue from sponsorships has significantly increased overall. We also shouldn’t forget the sleeve sponsor agreement with MSC, which is worth about €5m. Assuming that other sponsorships have remained the same, while there are likely some increases that haven’t been announced, the total increase for sponsorships is at least €35m.

The commercial sales, meanwhile, have brought in an additional €4.7m compared to the last financial year. The box office revenue, i.e. from ticket sales, has suffered a bit due to the Champions League exit. It will not be a huge difference but we are talking about a decrease of roughly €6m. At this point, taking all of the revenue increases we just discussed into account, the ‘Champions League drop’ has been completely absorbed.

So, what are the ‘bonuses’ in revenue for Milan? The biggest factor of last summer was obviously the sale of Sandro Tonali to Newcastle. Taking his departure and a few other minor departures into account, we land at a whopping €54m in capital gains. It’s also thanks to this sum that Milan will be able to record another profit on the balance sheet.

However, having said that, Milan would have reached the break-even point even if they just had registered the capital gains of 2022-23 (€6.6m). What this means is that the Rossoneri certainly benefit from hefty capital gains, but they are not reliant on them like some other clubs in Serie A. It’s not a survival tool but rather opportunities that can either be seized or rejected. Ultimately, the decision to sell a player is thus technical and not financial.

Squad costs can increase

Taking a look at the costs for Milan, the squad costs have remained more or less the same compared to the 2022-23 financial year thanks to the work done in the summer, having got rid of a few high-paid players. Based on this data, therefore, we can also see that the Rossoneri spend about 31% of their revenue on squad wages (players plus coaching staff). 34% if we don’t include the capital gain in the revenue.

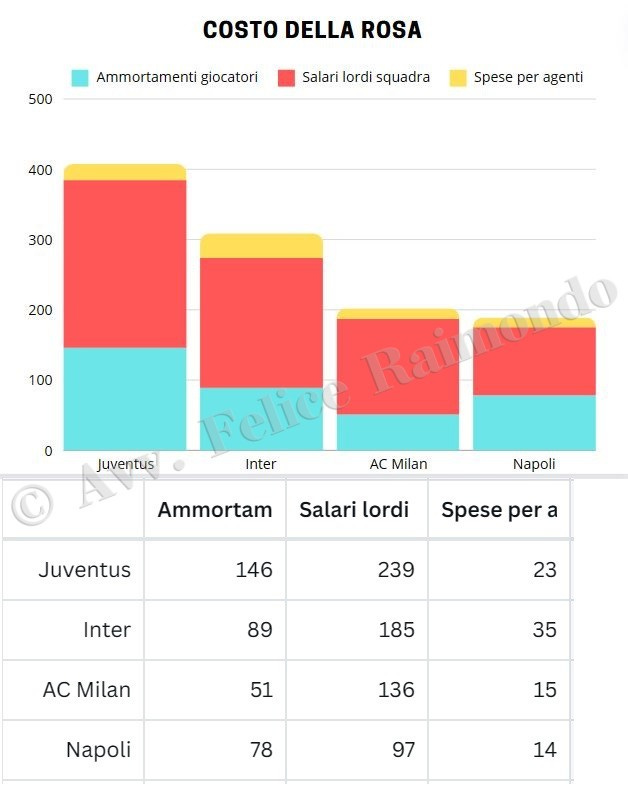

This is a very low figure for such a big club, especially considering that the likes of Inter and Juventus spend about 47% and 54% on wages respectively. The trend remains if we also look at just the amortisation costs of players: €89m for Inter, €146m for Juventus and €50.8m for Milan. In short, one could question whether the management is being too careful with the means of the club.

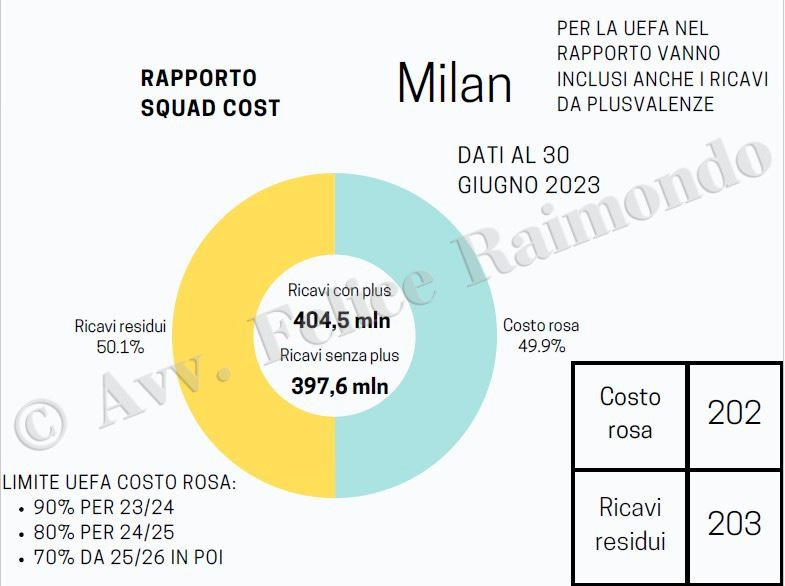

Adding all of the squad costs together - players, coaches, bonuses, amortisation and agent expenses - we arrive at €202m. In other words, 50% of the overall revenue and this is a figure that definitely could increase. The percentage is well below the limit imposed by the new UEFA regulations: 90% for the current season, 80% for the 2024-25 season and 70% from 2025-26 onwards. There is room for investments here.

We should also highlight the fact that Milan’s Settlement Agreement with UEFA stipulates that the maximum aggregate deficit can be €60m between 2022 and 2026. There are also so-called ‘interim goals’, meaning the Rossoneri also cannot exceed an aggregate deficit of €60m for the first two seasons (2022-2024). With €6.1m profit in 2022-23 and a projected profit of €32m in 2023-24, they can thus ‘afford’ to make a €100m deficit in the upcoming financial year.

Clearly, this will never happen, but it shows that the club is in very good financial shape and perhaps should let loose a little this summer. Winning by spending a mere 50% of the revenue on the squad is without a doubt more complicated for Milan than the clubs that spend between 65% to 80%, even if perfect seasons have occurred in the past (Milan in 2021-22 and Napoli in 2022-23).

As Raimondo points out, the overall costs for the club will be more or less the same as in 2022-23, which means that the increase in revenue hasn’t come at a high price. Bayern Munich are an example to follow, having almost always spent between 65-70% of the revenue on the squad whilst keeping the balance sheet in order. Their stadium plays a big part, of course, but also lower costs for ‘materials and services’ which suggest that Milan still have some ‘dead wood’ in the organisation to get rid of.

A goal in the next 5-7 years will be to break €600m in revenue without capital gains, but for now the second star must be pursued and not a third positive balance sheet, as Raimondo concludes. The latter is useless for UEFA purposes and would only benefit RedBird and its investors, as opposed to Milan and the fans. Investments are needed and above all, the Rossoneri can now afford to make them.